Forex affiliate programs are an excellent source of revenue for casino and poker affiliates looking to diversify their revenue streams into alternate affiliate niches.

What makes forex affiliate programs such a natural fit for casino affiliates? There are at least four good reasons:

1. Similar commission rates. Like gaming affiliate programs, forex affiliate marketing offers you the change to choose revenue sharing (revshare) or cost-per-acquisition (CPA) for your commission structure. And, like casino affiliate marketing, forex affiliate revshares can be found in the 25 to 45 percent range — much higher than other affiliate marketing commission opportunities.

2. Simplicity. Forex trading has exploded globally probably because it’s so simple — it’s either/or basis makes it not much different than online gaming. It also makes it easy for online buyers to participate in trading without being stock market experts or financial gurus.

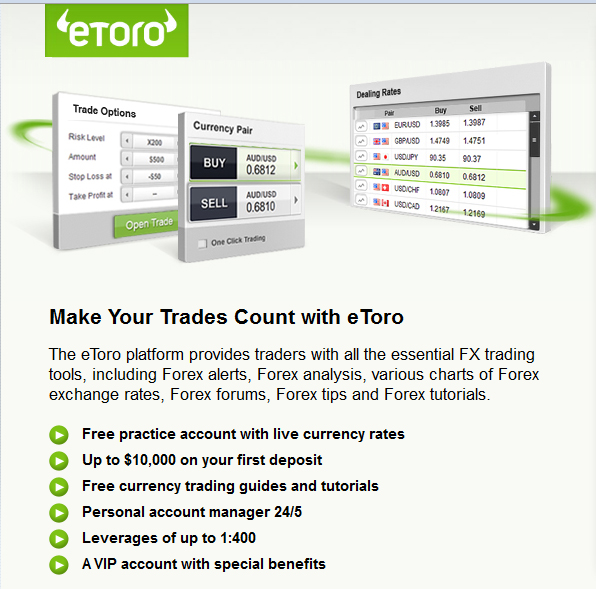

3. Similar marketing angles. Like casino affiliate marketing, forex affiliate programs give you everything you need to promote their sites: Banner ads, tracking links, landing pages, mailers. If you’ve already launched a website dedicated to gaming affiliate marketing, then adding forex will be a snap. Start with a separate page or blog post to introduce your forex partners, then grow it from there. “Forex customers can be recruited through campaigns which feature online business opportunities, new ways to earn money, gambling and gaming as well as many other keywords,” explains eToro.

4. Open to U.S. traders. Unlike gaming, forex trading sites aren’t blocked from U.S. buyers. So, especially if you’re facing a revenue shortfall because of the recent blocked online poker sites, forex affiliate marketing could be a way to get that revenue back.

What is forex?

Forex trading (literally, short for “foreign exchange”) is a relatively new development online that lets online traders exchange international currencies. The idea is to let buyers make money off the daily changes in the worldwide exchange rates.

Forex trading (literally, short for “foreign exchange”) is a relatively new development online that lets online traders exchange international currencies. The idea is to let buyers make money off the daily changes in the worldwide exchange rates.

The currencies that can be traded against each other are quoted in pairs, with one currency acting as “based”, the other as “counter currency”. For example, EUR/USD represents the euro as traded against the U.S. dollar.

That makes for simple trading: An online buyer knows exactly what’s being traded, and at the end of the day, how much money he or she has made.

And that simplicity is probably why forex trading “is the largest and most liquid market in the world,” according to Investopedia.com. “In 2010, it accounted for more than $3 trillion of daily trading.”

But there’s still plenty of room for opportunity. “The Forex affiliate market of today is where the gambling affiliate market was 6-7 years ago,” eToro says. “Not yet too crowded but growing at an incredible pace.”

A bright future

“Global foreign exchange market turnover was 20% higher in April 2010 than in April 2007, with average daily turnover of $4.0 trillion compared to $3.3 trillion,” say eToro reps, citing numbers from the Triennial Central Bank Survey 2010.

There’s no doubt: Because it’s perfectly positioned for simple internet trading, this growing market will continue to boom.

Get started here: Check out the list of CAP listed forex affiliate programs.

-

For Advertisers

-

List Your Affiliate Program

iGaming Services

Find a Gaming Product and Service Provider-

Services Categories

- Business Consulting

- Copyright

- Domains

- Hosting

-

For Advertisers

-

Sell My Product or Service Now!